There was a whole lot of discuss Ethereum overturning Bitcoin, particularly in 2017. through the bull cycle when the ETH/BTC ratio peaked at 0.157.

However till not too long ago, fueled by the continuing banking disaster narrative, Glassnode analyzed the information seethereality means that Ethereum’s efficiency shall be poor going ahead, which means the thought of a “rollover” has to pay.

Bitcoin – Ethereum realized that capital dominates

Market cap is the preferred solution to worth and evaluate cryptocurrencies. It’s calculated by multiplying the present worth by the circulating provide.

A variant of the market cap methodology is the realized cap, which replaces the present worth within the above calculation with the worth when the cash had been final moved. Proponents say this offers a extra correct estimate by decreasing the influence of misplaced and unreturned cash.

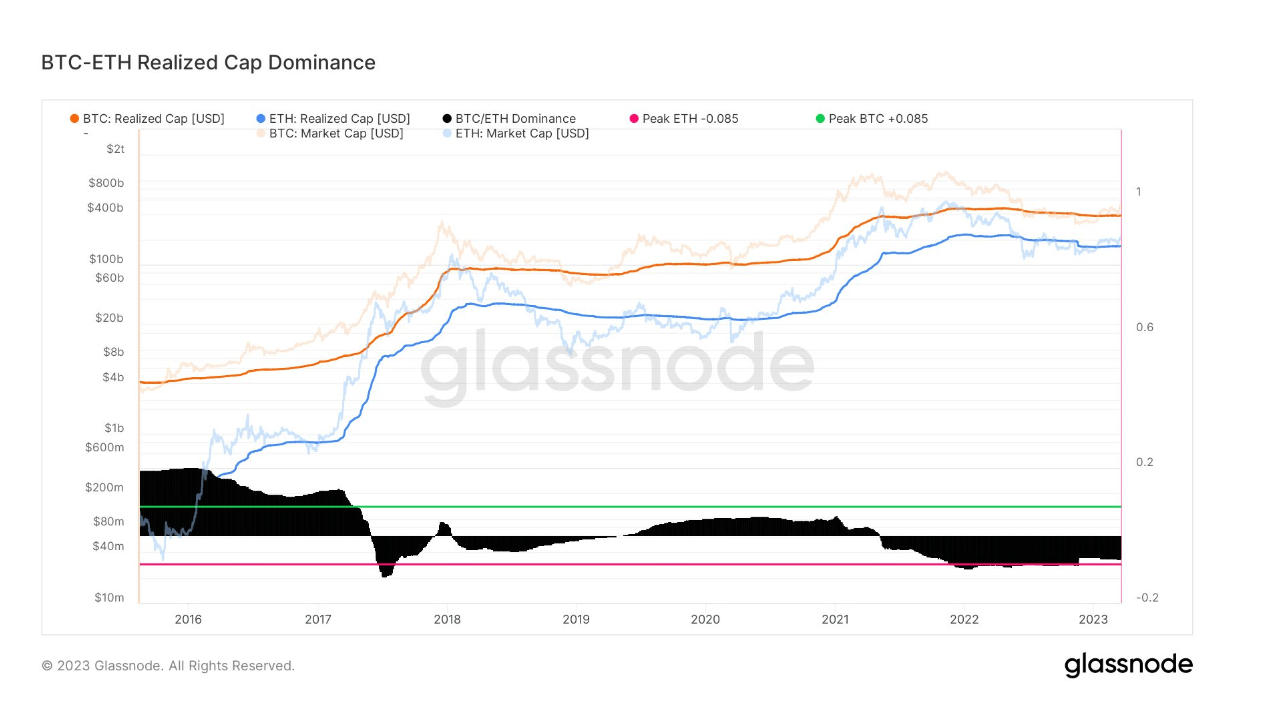

The chart under paperwork the Bitcoin and Ethereum market and realized caps since 2016. It exhibits that BTC and ETH have tightened in 2017. in June, particularly when wanting on the realized higher restrict traces.

Round 2019 in April the 2 started to separate. Nevertheless, by 2021 Might. these two bands narrowed even additional. Nevertheless, in latest weeks, the quantity of Ethereum has began to lower, whereas Bitcoin has been comparatively secure.

The chart additionally exhibits BTC/ETH dominance calculated by taking the BTC market cap and dividing by ((BTC market cap + ETH market cap) – 0.765). The quantity 0.765 visualizes the oscillator primarily based on the long-term common worth. This means that the market is beginning to depart ETH’s two-year interval of dominance behind.

Given the present scenario, markets are bracing for larger rates of interest and banks are persevering with to tighten credit score availability, a situation that usually favors danger belongings.

Ethereum is taken into account riskier and has the next beta than Bitcoin, suggesting that it’ll underperform the main cryptocurrency coming into a de-risking atmosphere.

Ethereum Fundamentals

Evaluation of Ethereum fundamentals additionally means that it will likely be short-term sooner or later.

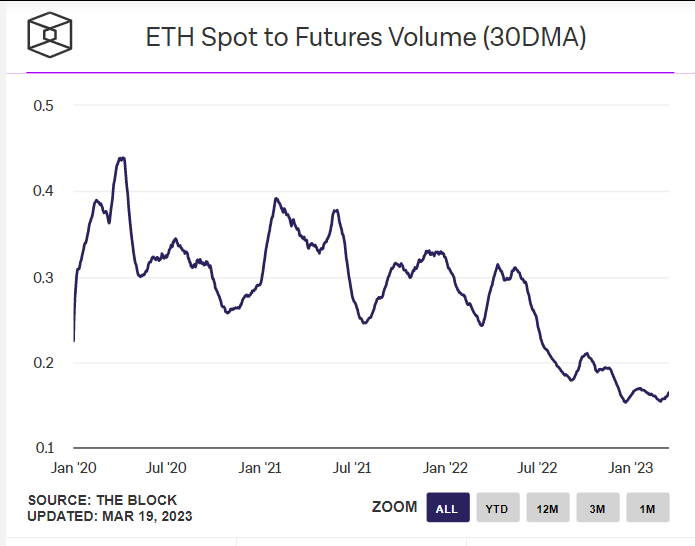

A common indicator of the ecosystem’s well being is a excessive/rising spot-to-futures ratio, indicating an ecosystem dominated by merchants with a deal with revenue relatively than perception within the ecosystem.

ETH Spot and Futures quantity block knowledge exhibits a macro decline since 2020. in April The downward development accelerated round 2022. Might. (Terra-LUNA explosion) and has since fallen to an all-time low.

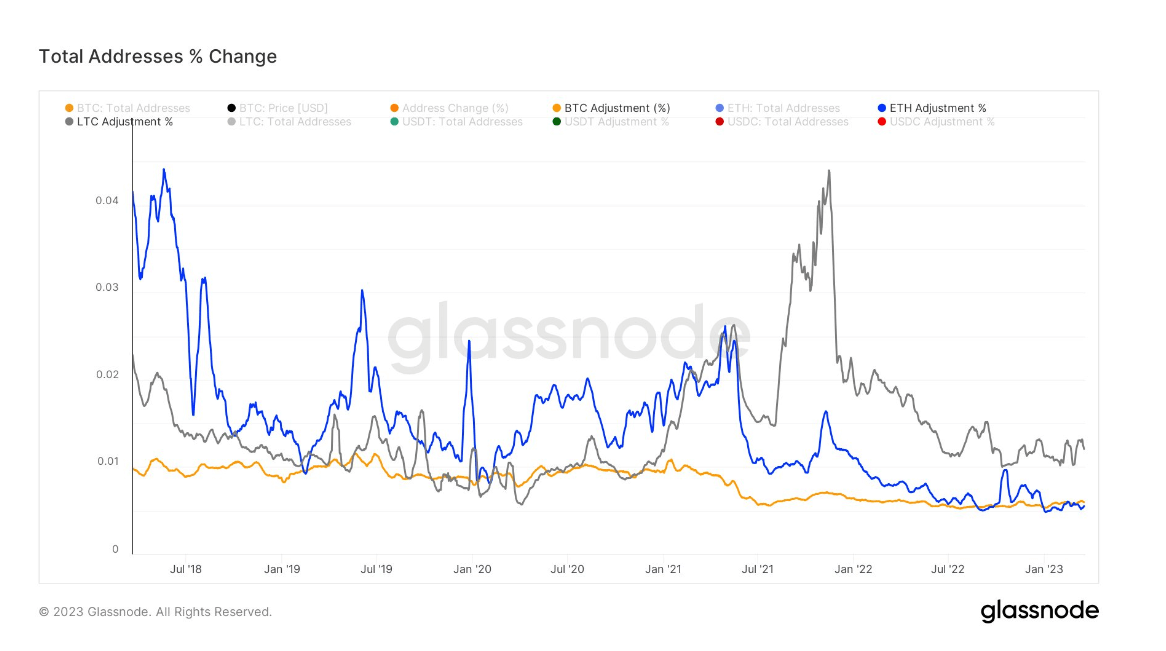

Over the previous 5 years, the share change of all ETH addresses has decreased, falling under BTC final month.

Additionally, the share change of all LTC addresses began to tug away from ETH (and BTC) round 2021. in June and has remained constantly larger since then, notably peaking round 2021. in November.

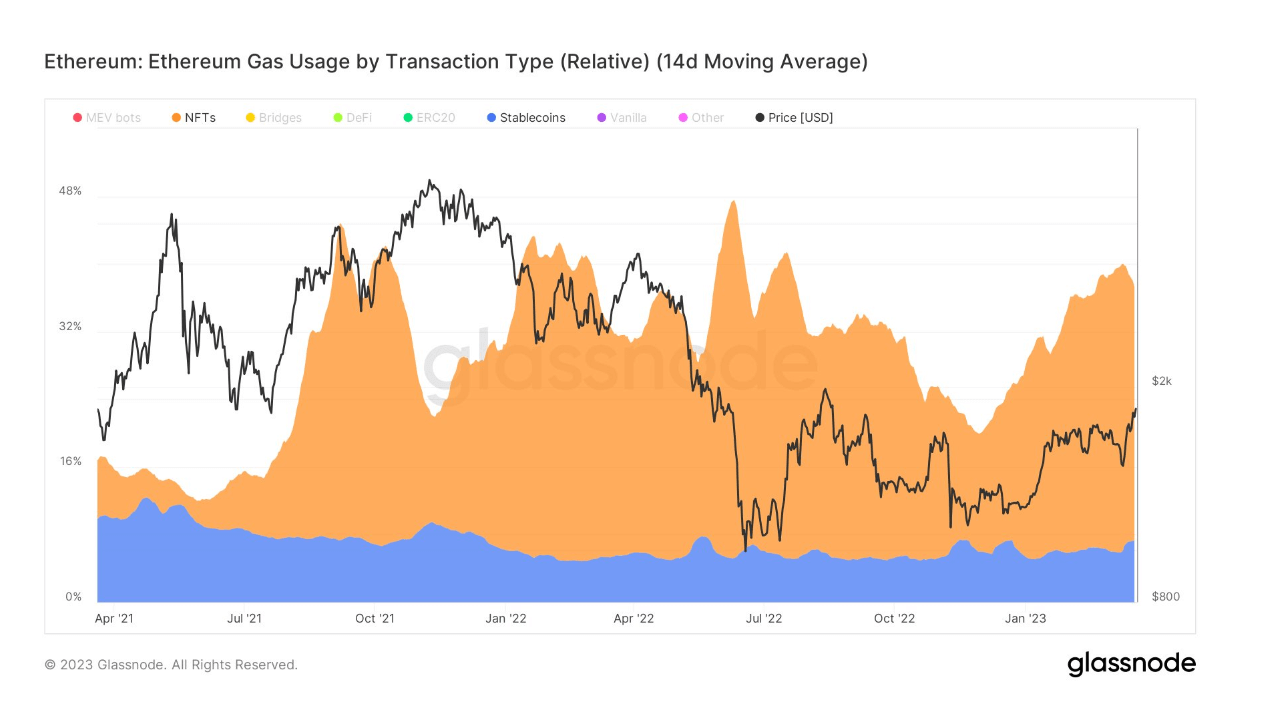

Information on the community exhibits that ETH is generally consumed by fuel brake cash and NFT transactions, with the previous rising round 2022. December.

in 2022 in June stablecoin and NFT transactions accounted for nearly half of ETH’s fuel consumption. This proportion is now round 35%, which exhibits the general decline of those applications on the ETH chain.

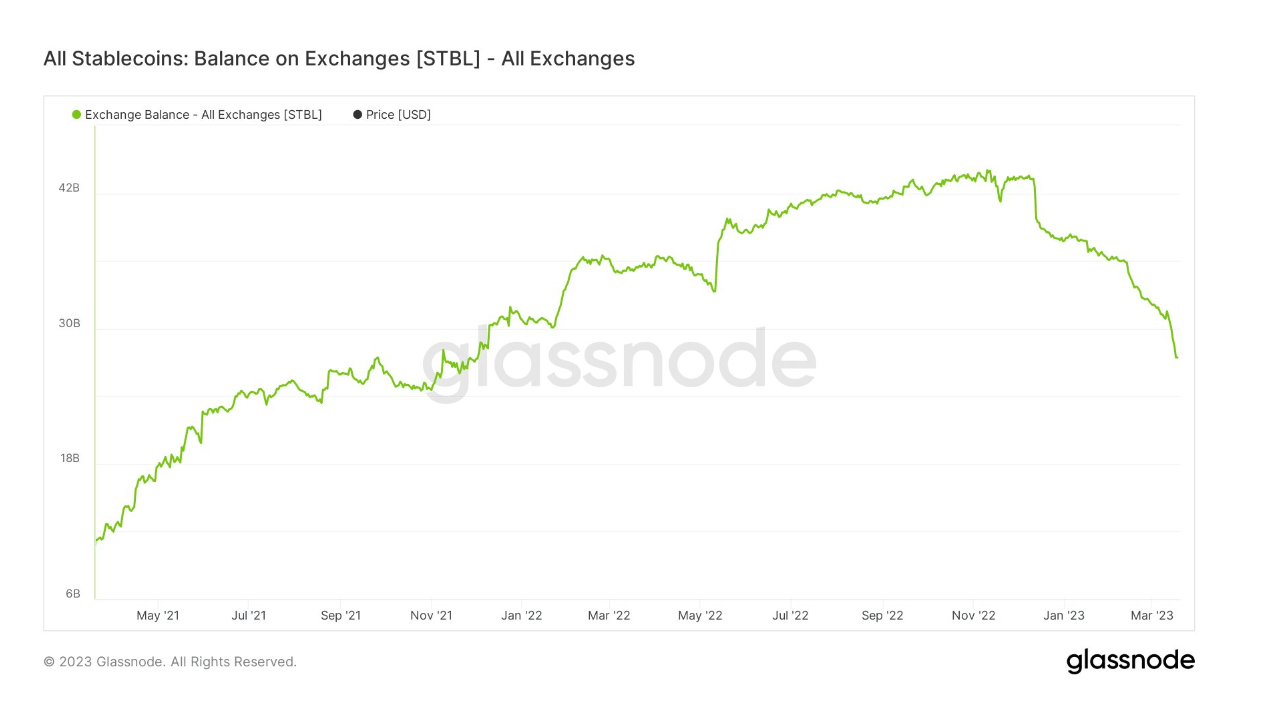

This may be defined by the rising recognition of Ordinals in BTC, which barely diminished the demand for ETH NFTs. Equally, stablecoins fell to 17-month lows on exchanges, indicating a common decline in cryptocurrencies, possible as a result of persistent narratives about their security/redemption.

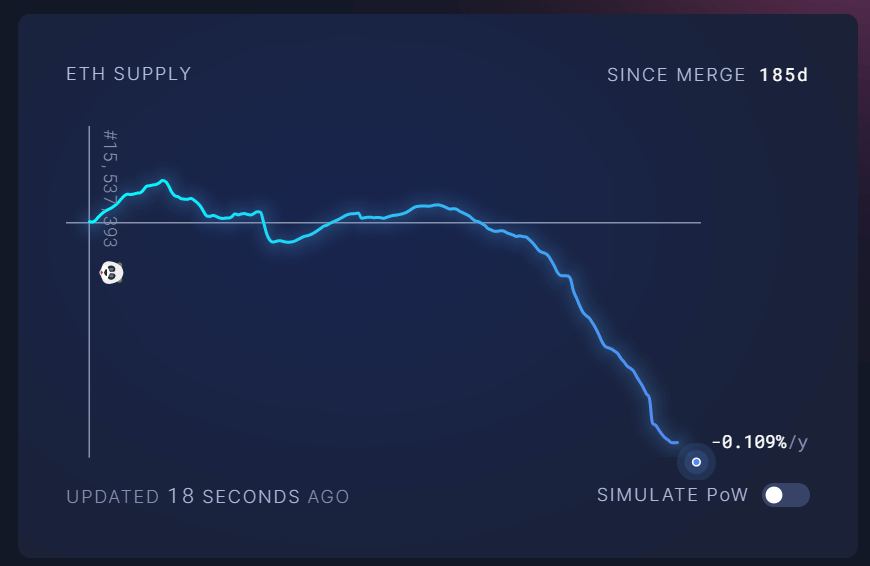

The Merger narrative has fueled excessive costs within the transition to Proof-of-Stake and deflationary Tokenomics. Nevertheless, greater than six months later, ETH continues to lose floor in opposition to Bitcoin. There could also be a number of causes for this.

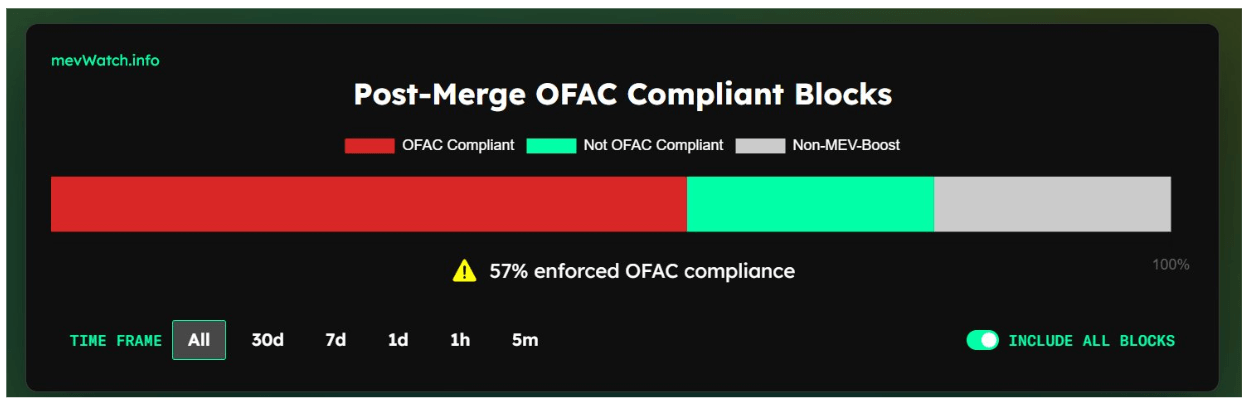

After the Twister Money sanctions, Ethereum’s status as an uncensored, decentralized chain took a significant hit. Greater than half of the blocks are nonetheless Workplace of Overseas Asset Management (OFAC) compliant, which means that greater than half of the community will exclude transactions ordered by US authorities.

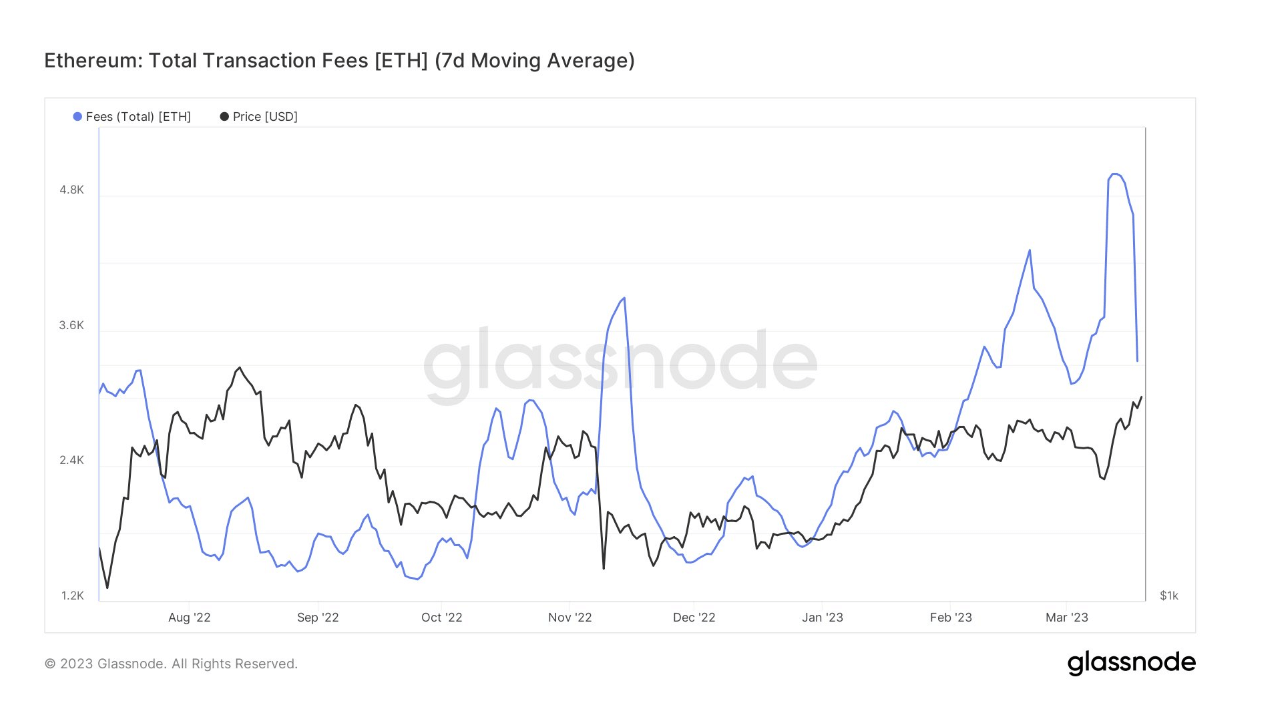

Additionally, whereas the builders have been clear in stating that the merger is not going to immediately scale back taxes, there’s nonetheless the unresolved problem of pricey transactions. The chart under exhibits transaction charges that not too long ago reached round 5K. ETH.

The ETH/BTC ratio is at the moment at 0.0635, lower than half of what it was in 2017. After the banking disaster, this ratio has dropped considerably, indicating that the market is extraordinarily favorable to Bitcoin in these unsure occasions.